Understanding Carrier Liability vs. Comprehensive Cargo Insurance

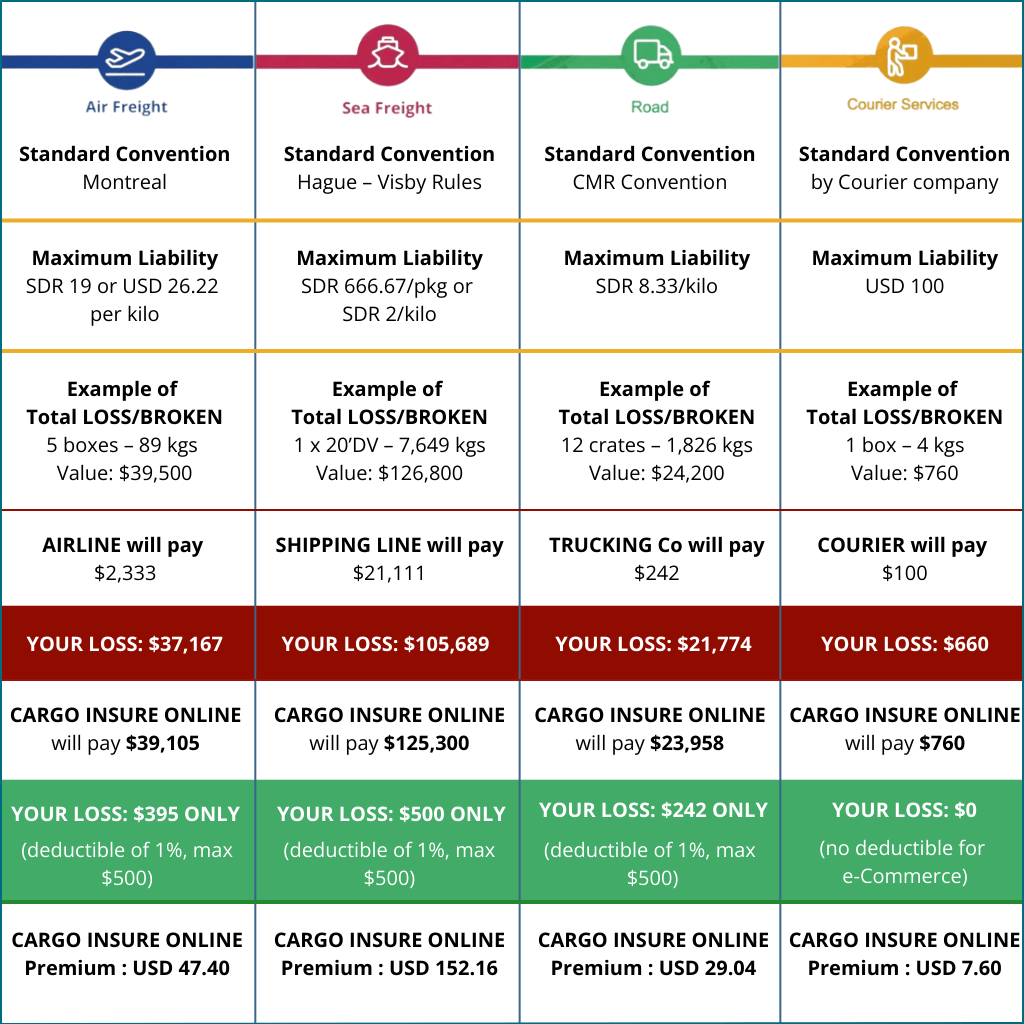

Carrier Liability Chart : Quick overview

When transporting goods, understanding the difference between standard carrier liability and comprehensive cargo insurance is essential for full protection. While carriers do provide limited coverage, it often falls short in terms of both the compensation limit and the scope of covered risks. Cargo Insure Online bridges this gap, offering shippers a reliable and extensive solution to secure their shipments from departure to arrival. With tailored options and benefits far exceeding standard carrier liability, Cargo Insure Online ensures peace of mind, covering risks such as full-value compensation, flexible deductibles, and streamlined claim processing for faster resolutions.

Why Choose Cargo Insure Online over Carrier Insurance?

Cargo Insure Online offers a comprehensive suite of benefits that address the gaps and limitations in standard carrier liability, including:

Full-Value Coverage: Carrier liability often limits compensation by weight or package count, which may not align with the shipment’s actual value. Cargo Insure Online provides coverage that reflects the full value of your goods.

Wider Risk Protection: Carrier liability typically excludes numerous risks, such as handling errors, delays, and certain environmental factors. Cargo Insure Online covers a wider array of risks, reducing the chance of unrecoverable losses.

Simple Claims Process: Navigating claims with carriers can be challenging and time-consuming. Cargo Insure Online offers a streamlined claims process, providing timely compensation and customer-centric support throughout.

Flexibility and On-Demand Coverage: Unlike fixed carrier insurance terms, Cargo Insure Online allows for customizable, on-demand policies that match specific shipment needs and budgets, offering flexibility without sacrificing coverage.

Carrier Liability vs. Cargo Insure Online Coverage Chart